Updated: April 27, 2021

One year into the pandemic, many have transitioned into online freelancing. I’ve seen many posts on several Facebook groups for freelancers asking if it’s okay to charge X dollars per hour for a full-time or part-time position. In efforts to help newbie freelancers out there, I thought I should update this post and come up with an easy-to-use tool.

(Note: The link to the downloadable spreadsheet below is still live if you prefer to use it.)

In this post:

“How much should I charge?”

This is easily one of the most common, yet complicated and challenging questions to answer.

Usually, for people who transition from the corporate world into a freelance, work-from-home setup, the idea is to simply calculate the hourly rate from their existing monthly salary.

To illustrate, if I earn Php 35,000 monthly from my full-time office-based position, I would most probably charge as follows:

Php 35,000/month divided by 20 working days per month divided by 8 hours per day

= Php218.75 per hour (~4.50 USD per hour)

The problem with this method is that additional expenses incurred to render these freelance services are not considered.

From employee to solopreneur

As soon as you embark on the online freelancer journey, you transition from being an employee into being a solopreneur. You are now responsible for all the overhead expenses, including office space, equipment, utilities, insurances, taxes, monthly contributions to SSS, Philhealth, Pag-ibig, etc.

I have been an online raketera for more than a decade now, and many freelancers have asked me countless times the dreaded question of “How much should I charge?” I also regularly ask myself this question to check if I am still meeting my target income.

So, I came up with a simple calculation that will help us freelancers calculate our minimum hourly rate, and I’m sharing it with you.

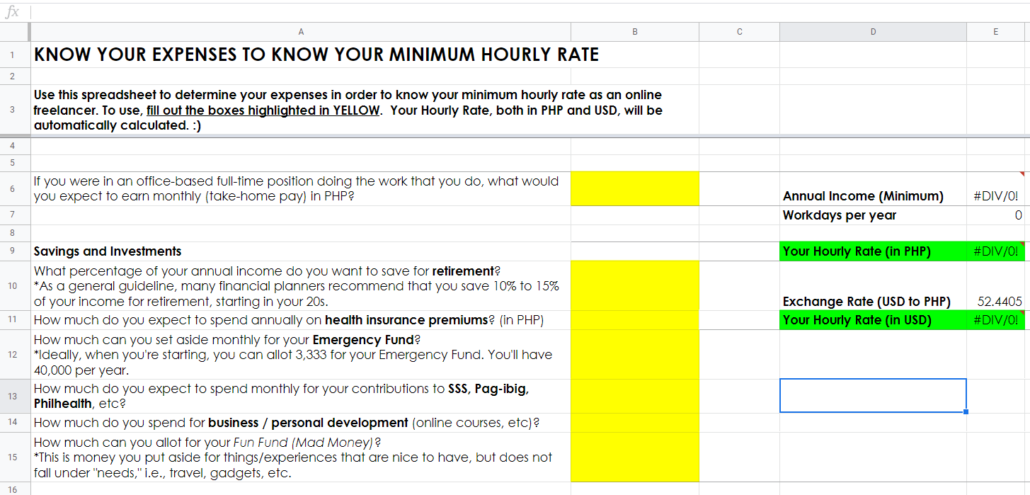

I also have a spreadsheet version if you prefer Google Sheets. Click here to download a copy.

I think it’s pretty straightforward — maybe a little overwhelming at first, but I made it as easy to use as possible.

If you need a tutorial, read on… Otherwise, head straight to the end of this post for “What to do next.”

How to use the spreadsheet

In order to calculate your minimum hourly rate, you need to work backward and start with determining your total expenses. You just need to fill out the needed information in the yellow boxes. All the necessary calculations are done for you.

It is divided into sections:

- Target income;

- Savings and investments;

- Business expenses; and

- Billable work hours.

BONUS TIP: What I really like to do when I fill this out is to maximize cash outflow (expenses) and use the minimum amount for my income.

For example, if I have an existing client hiring me for 10-20 hours per week, I would use the 10-hour workweek in the sheet for my income. And I’d use the higher range for utility bills (electricity, internet, etc.). This gives a little allowance for inflation and other changes in expenses and also creates a buffer, giving me a little peace of mind that I will not rattle that much if there are any sudden changes in my employment status or maybe a sudden increase in my cash outflow.

More money is better than dealing with shortages, riiiiight? Anyhoo, now back to the spreadsheet!

Income

- If you were in an office-based, full-time position doing the work that you do, what would you expect to earn monthly in PHP? Enter your target income here.

Savings and Investments

- What percentage of your annual income do you want to save for retirement?

As a general guideline, many financial planners recommend that you save 10% to 15% of your income for retirement, starting in your 20s. This percentage increases with age. - How much do you expect to spend annually on health insurance premiums?

In the corporate world, health insurance is usually covered by the employer as part of your benefits. As a solopreneur, this is now your responsibility. - How much can you set aside monthly for your Emergency Fund?

When you’re starting, you can allot Php 3,333 per month for your Emergency Fund. You’ll have Php 40,000 annually. - How much do you expect to spend monthly for your contributions to SSS, Pag-ibig, Philhealth, etc?

In the corporate world, employees only need to contribute 50% and the employers take care of the other half. As a freelancer, you are technically self-employed, so yes, you need to pay the full amount. - How much do you spend on business / professional development (online courses, etc)?

Learning never stops. Even when you are already working, you still need to invest in acquiring new skills. Take an online course, attend a seminar, or enroll in higher education. 🙂 - How much can you allot for your Fun Fund (Mad Money)?

Now the fun part! This is money you put aside for things/experiences that are nice to have but does not necessarily fall under “needs,” i.e., travel, gadgets, etc. You may want to save Php1,000 monthly for that dream vacation next year, or maybe Php3,333 per month so you have Php10,000 per quarter to splurge.

Business Expenses

- How much are your monthly expenses for utilities needed for the completion of your services/tasks?

Your bills go into this category, i.e. internet connection + phone + electricity + others - How much of your net monthly income goes to self-employment taxes?

Here’s a tax calculator from the Department of Finance: https://taxcalculator.dof.gov.ph/ - How much should you allot for accounting/bookkeeping fees?

You might need to hire someone to help you with bookkeeping and other admin services, especially for processing permits, etc. - How much do you expect to spend on marketing expenses and other overhead expenses?

This includes website hosting and maintenance, co-working space rentals when there are power/internet interruptions, food and transportation costs for client meetings, etc. - What percentage of your income should you allot for Upwork, Paypal, Payoneer, and/or bank transaction fees?

Upwork charges up to 20% of your income. - How much do you need for a new laptop/PC and other equipment you need for your career? In how many years do you expect to upgrade your laptop/PC and other equipment you need?

You need to take into consideration the depreciation of the equipment you need in order to deliver your freelance services.

Your Work Hours

One of the advantages of jumping into a freelancer career is the ability to take control of your time. You get to work when you are most productive and take a break if you need to. As freelancers’ compensations are usually output-based, meaning “no work = no pay,” you need to put into consideration the actual work hours and workdays you intend to put in.

- How many hours do you intend to work per day?

Full-time work is 8 hours. You may want to consider your break time if it is not paid. - How many days do you intend to work in a week?

Enter 5 if you take 2 days off per week - How many holidays do you expect to take off work in a year?

Of the 12 paid holidays salaried workers get in the Philippines, how many will you take off work? - How many vacation days do you expect to take off work in a year?

If you are replacing a job with 4 weeks of vacation, enter 20 days. - How many sick days and personal days do you expect to take off work in a year?

Now go back to the top section of the spreadsheet and check the boxes highlighted in green. That is your minimum hourly rate, both in PHP and USD. The exchange rate is automatically updated.

What to do next

You can use this spreadsheet as a financial planning tool. Set a target income, determine a ceiling figure for your cash outflow (savings, investments, expenses), and regularly check if you’re still charging within the range that you need to thrive.

In your freelancing journey, you will encounter clients who will request lower bids. Use this spreadsheet as your guide to determine how low you can get without compromising your budget and financial goals. You may still go for the lower rate, but check if you can make adjustments to reduce your expenses or maybe get another side hustle.

Feel free to play with the tool. Adjust your working hours. Find out how much you should charge with reduced work hours. Or increase your target income. If you think it’s reasonable to ask for a salary increase, go for it.

If you think you need to have a higher rate, but your skills are not up there yet, then your next plan of action might be to improve your skills and build your portfolio.

As a certified #TitaRaketera, I always say:

Do not sell yourself short but make sure you’re worth it.

Pingback: #PlannerNerd: FREE Printable Financial Planner | LovetteJam

Pingback: Beginners Guide to Freelancing [The What, Why and How of Online Job]

Pingback: How to Get into the Habit of Saving: 5 Tips to Get Started Now | LovetteJam | #TitaRaketera