Nearly everyone wants to be rich. We want to live in financial comfort and stability, to be able to buy anything we want and to have access to a first-class lifestyle. While the end goal is clear, it’s hard to know where to begin your wealth-building journey.

The best place to start is of course to learn the habit of saving. Saving is a foundational skill for wealth building.

One of the reasons many people do not save is “not earning enough to be able to save.” In all of the personal finance books I’ve read, there’s a common theme saying that “It’s not how much you earn; it’s how you spend.”

But first, a quick disclaimer: I am not a financial expert or financial advisor. I am just a regular tita who has been learning about personal finance, and I’d love to share what I’ve learned with you.

Update (December 2021): In an effort to continuously learn and grow as a financial literacy advocate and blogger, I applied as a financial advisor earlier this year. And I finally got my license last October! I studied hard, attended trainings, and passed the licensure exams. Yey! If you’re interested, we can create a personalized plan for you. Book a free financial planning session with me.

In this post:

My Story

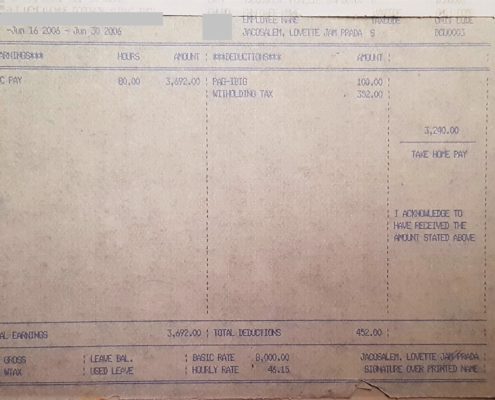

My first salary as a medical transcriber trainee was Php 3,240 for 2 weeks’ work. On the next payday, I got Php 3,059.61. That’s Php 6,299.61 net pay for a whole month of full-time work. It was the first time that I lived away from the family, so I had to take care of my living expenses, including rent, utilities, food, transportation, etc.). Living expenses in Cebu are considerably higher than what I was used to in a smaller, laidback city where I grew up in.

I needed to be strict with my budget because really, I just didn’t want to ask for money from my parents. It could be just pride, but I really worked hard to make sure I would have enough money at all times.

I remember I only bought a new pair of shoes when I saved a buffer amount of Php 10,000 on top of a payday’s amount in my bank account. I called it “buffer amount” back then, I had no idea about emergency funds.

When I left the corporate world and went freelancing a few years later, there was a point when I earned around Php 60,000 to Php 80,000 per month. I had moved back home then, so there was no rent and utilities to take care of. You’d think I would have started to build my wealth then.

But I was too stressed, so I would spend too much on travel and food and bags and shoes and whatever else because well, “I deserved it.” I didn’t grow my savings as much as I had hoped and I had zero investments to my name.

Yes, I’m living proof that “It’s not how much you earn. It’s how you spend.”

Thank goodness I woke up and started to clean up my financial mess. I’m not saying that I’m a millionaire now, but I’m in a much better financial position than when I YOLOed my income away. I’ve paid off my credit card debt, I’m currently taking care of my insurance/pre-need plans, and I’ve also started investing.

Okay. You didn’t click on this post to know about my story. You’re here looking for actionable tips to grow your savings. So, let’s go!

How to Get into the Habit of Saving:

Here are 5 techniques to get you started NOW:

1. Set your financial goals.

The main difference in my savings habit when I earned Php 6,000 versus Php 60,000 was my WHY.

When I started out, I needed to save money to survive and make sure I am able to take good care of myself. I had to have enough funds for me to be able to live comfortably and feel secure. I wanted to be able to fly back home when I need (or want) to.

When I earned more, I wasn’t as driven to build a healthy financial safety net for myself. My family is just with me. I know I’d always have a place to stay and food to eat. The downside is, I stopped having goals, (well maybe except for being able to afford grad school).

While starting out my journey as a strong, independent woman in Cebu, I was always saving up for tickets to visit home as much as I can and to travel with friends to detoxify and unwind. When I moved back home, I didn’t have that drive anymore. I felt like I have everything I would ever need, so I would just spend my “extra” money based on my um… whims and impulses. (And if you know me well enough, you know how crazy impulsive I could get.)

So if you’re starting, my first tip for you to start saving is to set your financial goals.

Whether it’s to save up for your emergency fund or a dream vacation or maybe for a big project like a downpayment for your own home, your first concrete step to financial freedom is to set clear SMART financial goals, meaning specific, measurable, attainable, realistic, and time-bound. Much better if you make it SMARTER: Specific, measurable, action-oriented, time-bound, evaluated and reviewed.

Having a clear vision is a strong driving force to save up. When you are anchored to your WHY, it’s easier to make sound financial decisions. Choosing to cook your own food and not buying the bag that was on sale becomes easier if you have your eyes set on the prize. Little savings each day do add up. Think of it as a gift to your future self.

2. Identify your money leaks.

It’s important to track your spending. For at least one month, list down ALL your expenses. You can do this on paper and list down what you spent during the day, up to the last centavo. Or you can use an app to do this. I recommend using the Money Manager app. You can do this every night so it won’t pile up and overwhelm you.

This exercise lets you know where your money went and where you could cut back.

Analyze your spending habit and identify your money leaks — those sneaky little expenses that you don’t even notice are eating up your funds.

Maybe you’ll see that if you pay off your credit card debts, you’ll save on interests and penalties. Perhaps it’s okay to cancel your cable connection because you have a Netflix subscription anyway. Or maybe you’ve been spending too much on specialty coffee when you can brew your own at home. Or it would make sense if you cut back your clothing expenses by 25% or perhaps limit your makeup spending to Php 1,000 per month.

When you are being completely honest about your spending, you are able to figure out your priorities and choose where you are most willing to cut back.

3. Keep a coin bank.

The trick to starting a saving habit is to just start. Focus on what you can do, not what you can’t. Even if it means starting by keeping all your loose change by the end of the day in a coin bank. The act of putting your money in one place can help motivate you to add to it since you can watch your efforts pay off.

The point of saving, even if it’s just a few pesos per day, is to start building the habit.

There are a lot of ‘ipon challenges’ out there to get you started. There’s the popular 52-week saving challenge, where you are challenged to save in peso increments weekly. Templates can be downloaded at Kuripot Pinay’s blog.

There’s also the Peso Sense Ipon Challenge, where there’s no specific saving schedule. You just need to complete the required number of bills within a year.

4. Do the invisible bills challenge.

Speaking of saving challenges, this one worked for me. The basic concept of the challenge is to not spend a specific bill. Hence, it is invisible. For example, you may commit to keeping all the Php 50 bills that come your way.

For me, I keep all Php 200 and Php 50 bills. I like that I’m saving without the pressure of a strict savings schedule or a specific number of bills to keep.

One of the challenges though is when you have no choice but to spend the invisible bills. I make it extra challenging for me and just save the next higher bill. If I spent a Php 50 bill, I’d have to put in Php 100; or Php 500 if I spent a Php 200 bill. It’s not like a punishment because after all, it’s still savings for me.

5. Pay yourself first and automate your savings.

This is a gamechanger for me. Financial literacy 101 often starts with the “Income – Savings = Expenses” rule.

✘ Income – Expenses = Savings

vs.

✔ Income – Savings = Expenses

A lot of people tend to follow the first equation, “Income – Expenses = Savings.” This means that you save the amount left after you spend your money. Oftentimes, spending first before saving means there will be nothing left for savings.

But a simple tweak to the equation can do wonders to improve the state of your finances.

The idea is to follow the “Income – Savings = Expenses” equation. This principle requires you to develop the discipline to save first before spending. Amazingly, you’ll learn to work with the money you have.

Automate your Savings

What helped me more was putting my savings on autopilot. I opened a separate bank account for my savings and scheduled money transfers from my main bank account to this new account. This gives me peace of mind that my financial goals are on track without necessarily paying much attention to them.

Surprisingly, I manage to make do with what is left for my expenses.

BONUS TIP

Yes, cutting your budget to save is great and all, BUT I believe making more money is great too. Extra income is always a great idea. Figure out a way to increase your income — whether it’s asking the boss for a raise, or increased work hours/workload, or looking for another client.

Oh, make sure you’re charging right for your freelance services too.

READ: How to Price Your Freelance Services: Know Your Minimum Rate

One thought on “How to Get into the Habit of Saving:

5 Tips to Get Started Now”